As Singapore continues to solidify its position as a major global financial hub, it presents significant opportunities for the growth and transformation of our financial advisory space.

This article aims to help financial advisers with useful references and highlight future trends and regulatory developments that are driving this boom and concludes with practical tips to upskill and navigate the dynamic Singapore market with purpose-built programmes such as the High Net Worth (HNW) Certification delivered by the Insurance and Financial Practitioners Association of Singapore (IFPAS).

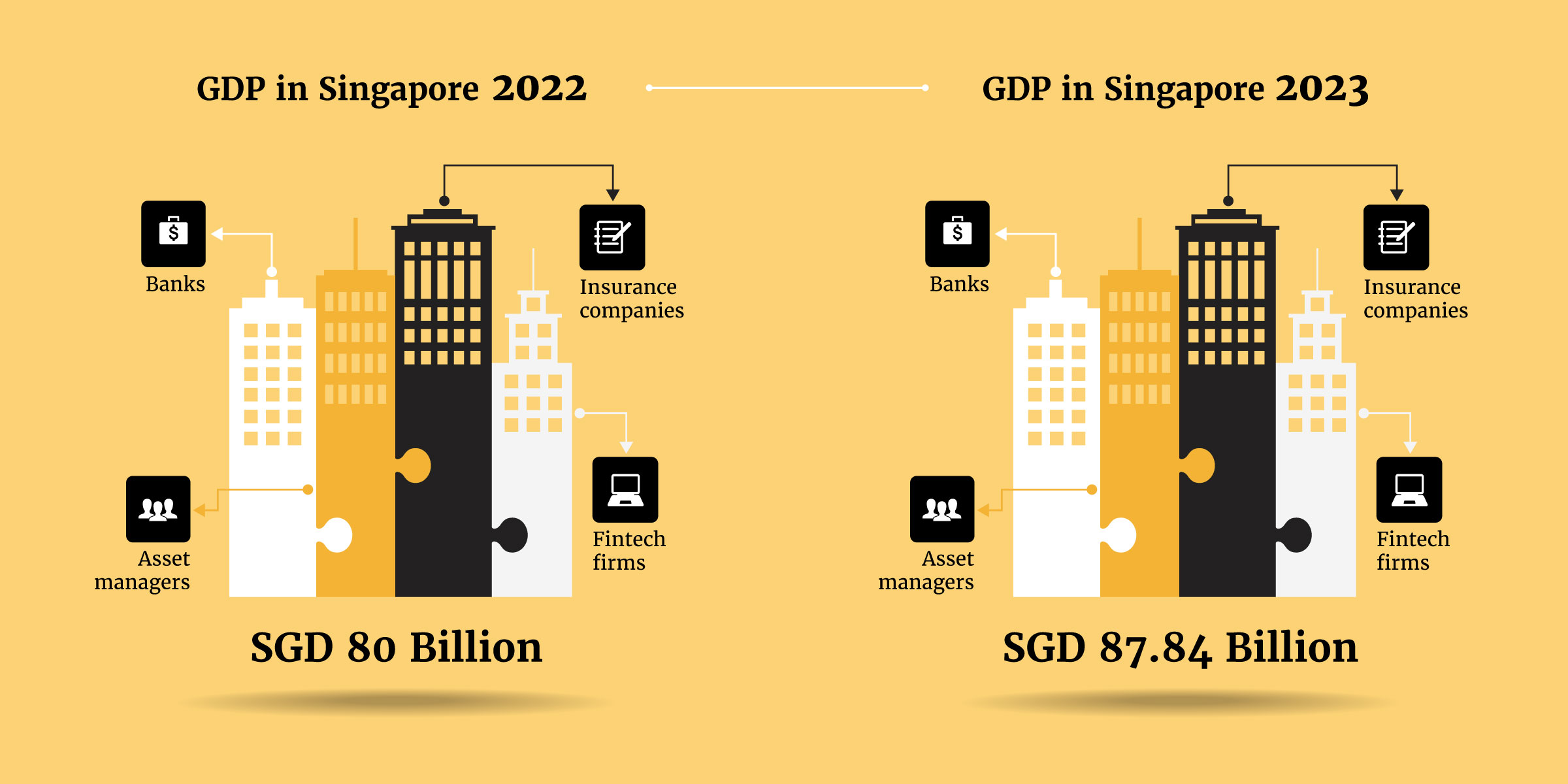

Singapore’s strategic location, political stability, trustworthy regulatory framework, and pro-business tax environment has made it a magnet for global financial services firms and HNW markets. Singapore is also home to a thriving ecosystem of banks, asset managers, insurance companies and fintech firms, all of which contribute to the substantial contribution of SGD 80 billion and SGD 87.84 billion GDP in Singapore for 2022 and 2023 consecutively .

In addition, Singapore is sealing its top spot as the choice location for family offices in Asia, with 50% of Southeast Asian family offices based here. This is a 100% growth in the number of registered family offices from 700 in 2021 to approximately 1,400 in 2023, reinforcing Singapore’s attractiveness as a wealth management hub for the affluent.

With the influx of opportunities, there is now a stronger, urgent need for financial advisers to align with the emerging trends of investing and regulatory developments across borders to understand the diverse and unique needs of these markets.

This trend is driven by a desire to achieve long-term value, while contributing positively to society and the environment, in the form of sustainable development goals and investments, and is gaining traction with the HNW individuals globally.

The Monetary Authority of Singapore's (MAS) efforts to promote sustainable finance are important in driving Singapore as the preferred financial hub and our transition to a low-carbon economy. The authority has launched several initiatives to encourage green finance, including the Green Finance Action Plan, which aims to position Singapore as a leading centre for green finance in Asia and globally. These initiatives create opportunities for financial advisers to explore new products and services that cater to the growing demand for sustainable investments.

Two noteworthy initiatives are the Green Bonds from Development Bank of Singapore Limited (DBS) and Green Loans from Oversea-Chinese Banking Corporation Limited (OCBC). DBS pioneered green bonds in 2017 with a $500 million bond aimed at financing projects that deliver clear environmental benefits like renewable energy installations, energy-efficient buildings and sustainable transportation projects. OCBC Bank offers green loan financing options supporting eco-friendly initiatives committed to sustainable projects, such as energy-efficient upgrades and renewable energy installations.

Financial advisers should stay educated, connected and well-informed about green finance products and ESG (environmental, social and governance) criteria. This will enhance their knowledge of the impact investing landscape and offer progressive advice to their clients who are interested in sustainable investing. This is one area explored in the first subject of the HNW Certification: Private Wealth and Family Office: Environment, Trends and Client Focus, which helps financial advisers to understand the needs and market trends of HNW clients and family offices, and requirements for providing advice in Singapore and other jurisdictions.

They can subscribe to updates from MAS and regularly participate in industry events like the Singapore FinTech Festival and the Sustainable Finance Forum. Networking with organizations like the Singapore Green Finance Centre and Singapore FinTech Association is a good start. Another recommendation is subscribing to publications focused on this trend, such as Eco-Business, The Business Times Green Pulse podcast, and the MAS Sustainable Finance newsletter, while contributing actively to the thought leadership forums on this trend on LinkedIn.

Technological advancements are evolving and will continue to do so. The key to conquering these changes is to work in tandem with technology, be aware of the digital landscape and services available in the market and reshape our paradigm to embrace the digital trends and offer our customers a holistic picture. For instance, financial advisers can be the one-stop advisory point for all customers to understand how to navigate efficiently across each financial institution's digital offerings for optimal servicing. By leveraging consolidated data, advisers can optimize strategies and provide bespoke solutions that enhance the financial outcomes for their high-net-worth customers. An example is the SGFinDEx initiative that was introduced with the customer at the core, allowing for enhanced financial planning with consolidated data across financial institutions. This will enable customers to create detailed financial plans considering their existing coverage, optimise savings, and effectively manage liabilities and policies across companies.

The bottom line is financial advisers need first-hand experience with these tools to value add and enhance customer engagement. Whether it's OCBC's AI-powered assistant Emma offering personalised financial insights, Prudential's Pulse app delivering health services through AI, Great Eastern's Great Advice platform for digital financial planning, or AIA Vitality's integration with health tracking devices, the knowledge empowers them to help customers navigate and optimise the digital landscape effectively. This will also help you build stronger trust with your clients, positioning you as their go-to point for all financial advisory matters.

Singapore is now home to a melting pot of global cultures and a multi-generational customer base, making it difficult to define a ’typical’ customer profile. With a 27% increase in mixed marriages in Singapore from 2020, the need to understand and cater to this diversity is pivotal for financial advisers in providing value to the rising influence of Gen Y and Gen Z in the workforce. This is in addition to the emerging needs of the latest Alpha generation as consumers of financial services.

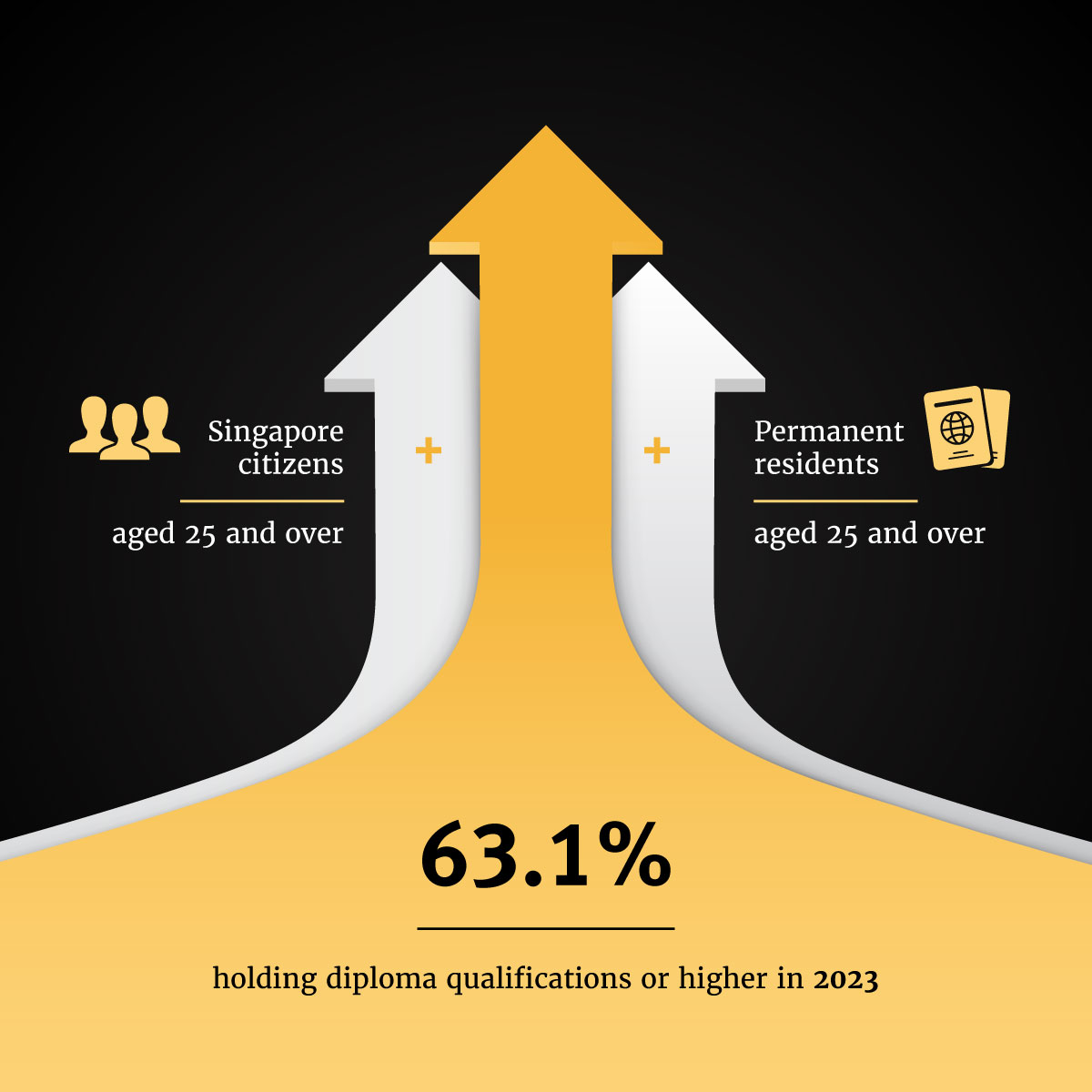

Moreover, with 63.1% of Singapore citizens and permanent residents aged 25 years and over holding diploma qualifications or higher in 2023, financial advisers are now serving more informed and educated customers.

As informed by a Standard Chartered Bank report, there is another emerging group of altruistic investors from 2018, who are more willing to accept a financial trade-off between doing good and generating returns.

Hence, the need for financial advisers to continuously upgrade and upskill to stay ahead and swiftly adapt their strategies to address the unique financial needs, while tapping into significant growth opportunities of these evolving customer profiles is critical.

Financial advisers can leverage the widely available data analytics to gain insights into consumer behaviour and generational preferences that can help them tailor their services and offer personalised advice that resonates with their clients and their demographics.

In a survey conducted by Sunlife in 2023, 39% of customers identified financial education as a key desire for better access and professional help in financial management. Hence, differentiating oneself through specialised knowledge, such as the High Net Worth (HNW) Certification, can provide a significant edge and make financial more attractive to customers.

The next few years promise significant growth and transformation in Singapore’s financial landscape. For financial advisers, it is key to navigate the emerging trends and upskill to differentiate and optimise the opportunities with victory.

*Additional stats above are from: Singapore Department of Statistics and EDB

This information you have provided will be treated with the strictest confidentiality and in accordance to the IFPAS Data Protection Policy and Kaplan Australia Privacy Policy.